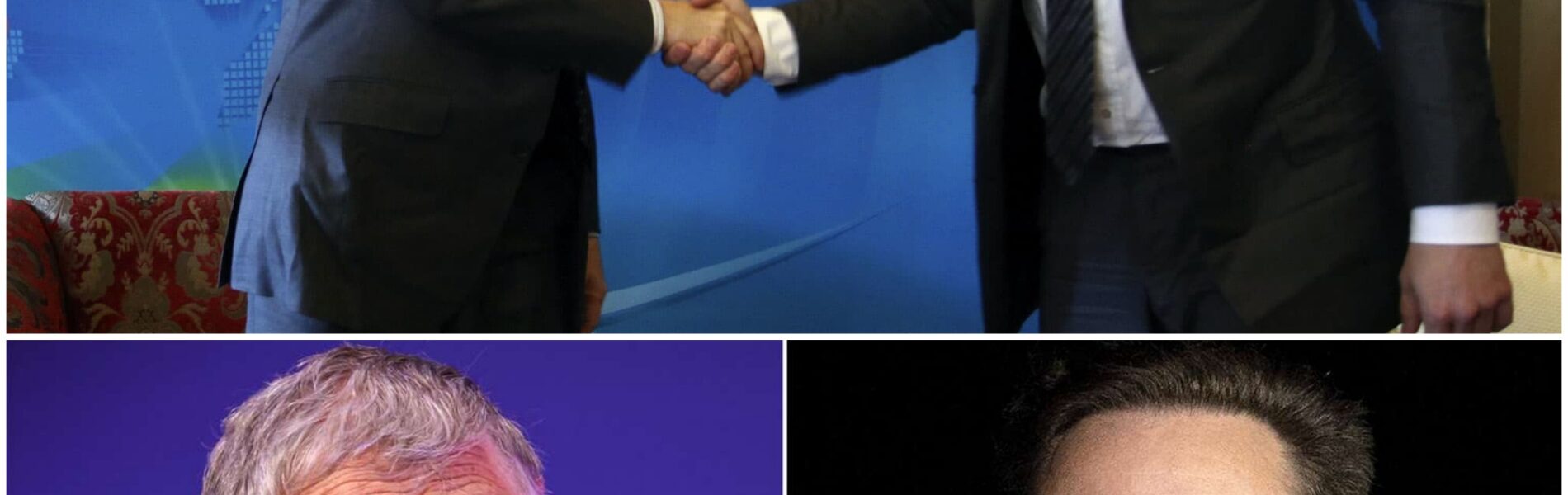

The tech and financial worlds were rocked today as Elon Musk publicly clashed with Bill Gates, sparking one of the most dramatic moments in recent billionaire rivalries. The confrontation began with a high-profile social media post from Musk, in which he warned that Gates’ Tesla-related investments could face catastrophic losses. Within minutes, the post went viral, igniting intense debates across social media platforms, rattling Wall Street analysts, and sending shockwaves through global markets.

Musk’s warning was direct, unambiguous, and unmistakably personal. It wasn’t a vague market prediction or a cautious commentary; it was a targeted statement with immediate implications for one of the world’s wealthiest men. Investors, traders, and financial media scrambled to interpret the meaning behind Musk’s words. Was this a genuine warning about Tesla’s trajectory? Or was it a calculated move in a complex game of billionaire brinkmanship? Either way, the market reacted instantly.

Stocks linked to Tesla experienced sudden volatility, with some investors pulling back in fear while others doubled down, betting on Musk’s track record of turning audacious predictions into reality. Analysts described the situation as extraordinary—not just because of the scale of wealth involved, but because it felt personal, almost cinematic. Two of the most influential figures in tech were publicly entangled, and every tweet, every comment, and every headline amplified the tension.

The dynamics of this clash highlight the unique positions both men occupy in the modern tech ecosystem. Elon Musk, CEO of Tesla, SpaceX, and owner of Twitter (X), has always been a figure who blends innovation, risk-taking, and provocateur-like communication. His public statements have historically moved markets, influenced investor behavior, and shaped media narratives. Bill Gates, co-founder of Microsoft and a billionaire investor with a broad portfolio, has maintained a more measured public profile in recent years, focusing on philanthropy, clean energy, and technology investments.

By calling out Gates’ Tesla-related investments, Musk inserted himself into a narrative that goes beyond standard market commentary. It was not just about stock performance or investment strategy; it was a public challenge between two titans of technology, one who thrives on disruption and unpredictability, and one who embodies strategic, calculated wealth management. The clash has captivated the public imagination precisely because it is both personal and high-stakes, combining financial risk with celebrity-level intrigue.

Wall Street analysts reacted swiftly. Many noted that Musk’s warning could trigger broader consequences for investor confidence in technology and renewable energy sectors. Market sentiment is sensitive to high-profile statements from industry leaders, and Musk’s post had the potential to catalyze a ripple effect. Investors began reassessing positions not only in Tesla but also in companies associated with Gates’ broader portfolio, attempting to quantify the potential exposure to any losses implied by Musk.

Social media became a battleground of speculation and commentary. Investors, tech enthusiasts, and journalists dissected every word of Musk’s post. Some argued that he was genuinely concerned about overvaluation or market dynamics, while others saw a strategic play, a deliberate provocation designed to destabilize or test Gates’ response. Memes, tweets, and viral threads spread rapidly, making the Musk-Gates clash a cultural phenomenon beyond financial circles.

Inside industry circles, insiders described the moment as unprecedented. One anonymous hedge fund manager said, “We’ve seen CEOs make market-moving statements before, but rarely between two individuals of this stature in such a personal tone. This isn’t just financial analysis—it’s a high-profile confrontation that affects not only stock prices but also reputations and influence.”

The stakes could not be higher. Both Musk and Gates have invested billions into technology that shapes the future—from electric vehicles and clean energy to software infrastructure and artificial intelligence. A public confrontation threatens to inject uncertainty into markets that rely heavily on investor confidence and perception. Every Tesla move, from production targets to strategic partnerships, is now under heightened scrutiny. The same applies to Gates’ investment decisions, as analysts and the public alike watch for any sign of reaction.

:max_bytes(150000):strip_icc():focal(999x0:1001x2)/Bill-Gates-Elon-Musk-71f6dcc17d124342b36a0b67dda97fa4.jpg)

Musk’s communication style has long blurred the lines between personal commentary and corporate influence. His history of using social media to shape narratives, combined with his penchant for audacious claims, makes any public statement potentially market-altering. Gates, by contrast, has typically avoided such direct, confrontational engagement. The tension between Musk’s theatrical, risk-embracing approach and Gates’ strategic, calculated methodology heightens the drama and underscores the unpredictability of modern billionaire influence.

Financial consequences aside, this clash represents a new kind of power dynamic in the tech world. Public perception, media amplification, and social media virality have become as influential as traditional market forces. Musk’s statement, regardless of Gates’ eventual response, has already reshaped conversations about Tesla, investment risk, and the interplay of personal influence with global capital markets. Investors are now weighing not just company fundamentals, but the personalities of the individuals steering corporate and financial decisions.

While speculation continues, one fact is clear: Musk has successfully captured global attention, demonstrating the potent intersection of wealth, media, and personal influence. The next steps are uncertain. Will Gates respond publicly, potentially escalating the feud, or will he maintain his measured approach, letting the market interpret Musk’s statement without further comment? The answer could redefine how investors perceive risk associated not just with Tesla, but with billionaires’ public statements and strategies in general.

As analysts continue to parse every tweet, every public comment, and every market movement, the broader lesson emerges: in today’s hyperconnected financial landscape, personal rivalries between influential figures can directly impact markets, investor behavior, and global perception. Musk’s warning about Gates’ Tesla-related investments is not just a statement about stock prices—it is a high-stakes interplay of ego, influence, and power that has captured the imagination of both financial and public audiences.

In the coming days, markets will adjust, investors will reassess, and both tech icons will navigate the fallout. Yet the moment itself—public, dramatic, and unprecedented—serves as a reminder that in the modern world, words alone, especially from those with immense influence, can move billions of dollars, shape industries, and create global conversations overnight.

For now, all eyes remain on Bill Gates’ response—or lack thereof—and the implications this showdown will have for Tesla, Gates’ investments, and the perception of billionaire influence in technology and finance. One thing is certain: Elon Musk’s words have made the world watch Tesla, Gates, and their intertwined fortunes with renewed intensity, proving that in the age of social media and instant communication, personal rivalries can become global events with far-reaching consequences.