MisterGreen, a 17-year-old Dutch car rental company that famously went “all-in on Elon Musk” with a strict policy of renting only Tesla vehicles, is now teetering on the edge of bankruptcy. Once hailed as a bold pioneer in the European electric vehicle (EV) rental market, the company is now selling off its operations in the Netherlands and Belgium to Rebel Lease, a subsidiary of Kroymans Leasing. The deal is expected to close in Q1 2026. In Germany, MisterGreen’s fleet and client portfolio will be acquired by Van Mossel Autolease, including 600 Tesla vehicles and 250 corporate clients, with the transaction also set to conclude in early 2026.

Founded in 2008 by two friends, Florian Minderop and Mark Schreurs, MisterGreen began modestly, renting electric scooters from Taiwan before moving to EVs. Minderop, born in oil-rich Venezuela, was inspired by the vision of a cleaner world powered by electric transportation. The company’s first EV rental was a Nissan Leaf in 2011, operating within the limited 100 km range that existed at the time due to the lack of fast-charging infrastructure in the Netherlands.

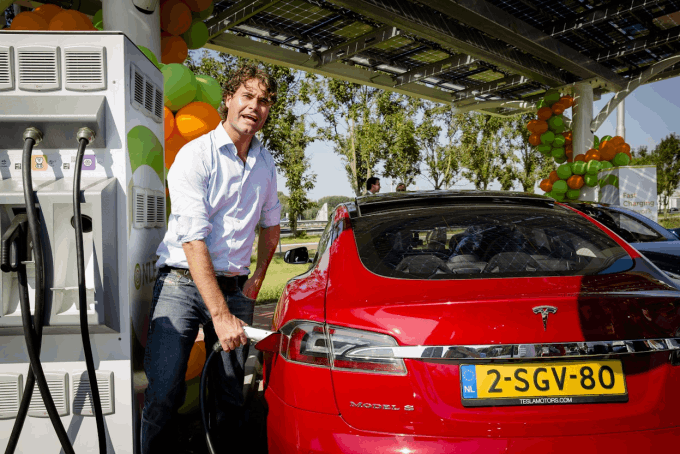

MisterGreen first encountered Elon Musk via the 2011 documentary Revenge of the Electric Car, released on Earth Day, which documented Tesla’s early rise. By 2013, when Tesla expanded to the Netherlands, MisterGreen became the first local rental company to purchase Musk’s vehicles, acquiring 100 Tesla cars. This gamble was a pivotal moment that would define the company’s trajectory for the next decade.

In a 2022 interview with YouTuber Herbert Ong, who specializes in Tesla stock analysis, Minderop recounted a meeting between MisterGreen executives and Elon Musk at a Dutch Tesla showroom. The executives reportedly made a bet with Musk: if they managed to sell 250 Tesla vehicles in the Netherlands, eight members of the leadership team would be invited to visit Tesla’s factory in the U.S., each receiving a Model S as a reward. Remarkably, MisterGreen achieved this milestone, cementing their reputation as audacious and innovative.

However, the company’s extreme commitment to a Tesla-only fleet introduced significant vulnerabilities. In recent years, several factors converged to put enormous financial strain on the business. Tesla’s brand faced reputational challenges due to Musk’s political involvement, particularly his alignment with former U.S. President Donald Trump, which sparked criticism and affected consumer sentiment. Meanwhile, the Dutch EV market slowed as government incentives were cut, including the removal of road tax exemptions for EVs. The secondary market for used Teslas also surged, as leased vehicles reached the end of their contracts in 2024, while Tesla continued aggressive discounting of new models to stimulate sales.

The impact on MisterGreen’s finances was swift and severe. By 2023, the company suffered a €41.3 million loss in asset value as Tesla vehicles depreciated faster than expected. That same year, the company paused interest payments to subordinate bondholders—small retail investors who had collectively invested €20 million via the platform DuurzaamInvesteren. According to Dutch media outlet NBR, MisterGreen also quietly auctioned off Tesla cars to meet bank obligations.

Electrek noted that MisterGreen’s financial collapse underscores the risks of placing blind faith in Musk’s claims that Tesla vehicles would become appreciating assets due to future full self-driving (FSD) capabilities—a promise Musk first publicly touted in 2019. The company’s 2022 annual report explicitly acknowledged that their Tesla-only strategy was driven by the belief that the cars represented the highest-quality EVs on the market, thanks to superior battery performance, over-the-air software updates, driving range, and access to the Supercharger network. They also assumed Tesla’s hardware and software would be ready for fully autonomous driving, fueling expectations of long-term vehicle appreciation.

Reality, however, diverged sharply from these assumptions. Tesla vehicles depreciated more quickly than the industry average, primarily due to the company’s frequent price reductions to maintain demand. Furthermore, Tesla has yet to deliver on its promise of hands-free driving via FSD, leaving rental operators and individual owners reliant on the vehicles’ expected future value—which never materialized.

For Tesla buyers, falling prices are good news. For fleet operators like MisterGreen, holding thousands of depreciating vehicles purchased through leverage proved catastrophic. The company had issued bonds to finance vehicle acquisitions but has been unable to meet debt obligations since the previous year. While the exact losses to investors are unclear, estimates suggest that tens of millions of dollars may have evaporated.

Electrek illustrated the risk with a stark example: “If you bought a single Tesla for $50,000 in 2022 expecting it to be worth $100,000 someday, you might be disappointed. But if you borrowed to buy 4,000 Teslas, congratulations—you’re MisterGreen.”

The CEO, Florian Minderop, and co-founder Mark Schreurs have yet to publicly comment on the impending bankruptcy or address investor concerns. Their ambitious gamble—anchored on the prestige of Elon Musk and the assumed appreciation of Tesla vehicles—serves as a cautionary tale for companies and investors betting heavily on a single manufacturer’s vision.

MisterGreen’s story reflects both the promise and peril of the EV revolution. On one hand, the company helped normalize electric mobility in Europe, inspiring broader adoption of sustainable transport. On the other hand, the company’s overreliance on Tesla’s performance and future FSD potential exposed it to unprecedented risk.

Tesla’s market dynamics—particularly aggressive price reductions and slower-than-expected autonomous technology rollout—highlight the volatility inherent in aligning a business model too closely with a single tech visionary’s projections. While Musk’s ventures continue to dominate headlines, MisterGreen’s collapse demonstrates that even the most innovative companies in the EV space are not immune to financial and operational pressures.

Looking ahead, the Dutch rental market is adjusting. Rebel Lease and Van Mossel Autolease, the acquiring companies, will integrate Tesla vehicles into their broader fleets, diversifying risk while continuing to capitalize on the growing demand for electric cars. MisterGreen’s cautionary tale, however, will remain a stark reminder of the dangers of “all-in” strategies, even when betting on the world’s most prominent tech entrepreneur.

In conclusion, MisterGreen’s bankruptcy is not just a business failure—it is a story about the complexities of innovation, the unpredictable nature of emerging technology markets, and the dangers of relying too heavily on a single company’s vision. What seemed like a bold alignment with the future of mobility turned into a cautionary example of risk concentration, highlighting that even the most successful tech innovations carry financial peril when leveraged without safeguards.