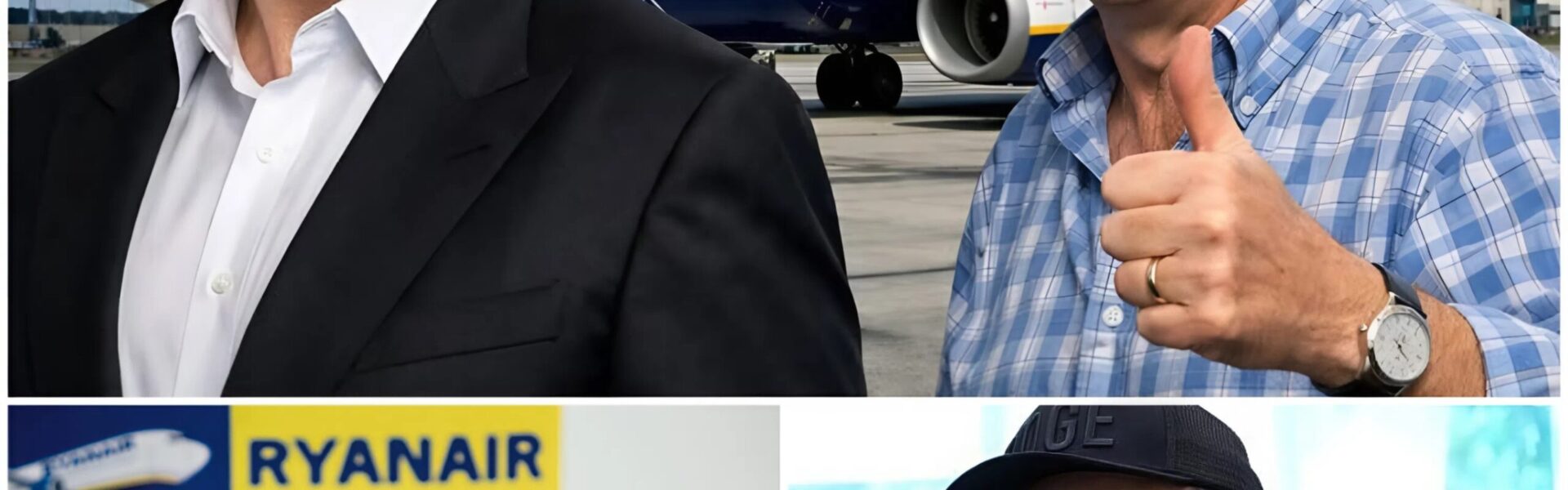

When Elon Musk jokes, the world listens—especially when his humor involves casually buying an entire airline.

What began as a public spat between Musk and Ryanair CEO Michael O’Leary has now turned into one of the most talked-about hypotheticals in global business: Could Elon Musk actually buy Ryanair? And more importantly—would he?

During an online exchange that quickly caught fire, Musk reportedly quipped that he could simply buy Ryanair outright. The comment was delivered with Musk’s trademark mix of sarcasm and bravado, but insiders and analysts wasted no time doing the math. Their conclusion? It would likely cost Musk between $35 and $40 billion—depending, as critics joked, on whether he wanted Speedy Boarding included.

A Clash of Two Unfiltered Titans

Elon Musk and Michael O’Leary are, in many ways, mirror images of each other across industries. Both are outspoken, combative, unapologetically blunt, and allergic to corporate politeness. Neither shies away from controversy, and both have built empires by rejecting conventional wisdom.

O’Leary has long positioned Ryanair as the anti-airline airline—no frills, no apologies, and no patience for what he views as inefficiency. Musk, meanwhile, has built his reputation by attacking bloated systems, whether in aerospace, automotive manufacturing, or social media.

When two figures like that collide, sparks are inevitable.

The dispute reportedly centered on comments about technology, efficiency, and innovation—territory Musk rarely avoids. What made headlines, however, wasn’t the argument itself, but Musk’s offhand escalation: the suggestion that instead of arguing, he could simply buy the company.

Could Musk Actually Afford Ryanair?

From a purely financial standpoint, the answer is straightforward: yes.

With an estimated net worth fluctuating between $750 and $800 billion, Musk has the capacity to acquire Ryanair without threatening his broader financial position. Ryanair’s market capitalization typically sits in the $30–35 billion range, and a takeover premium would likely push the final price closer to $40 billion.

For Musk, that figure would represent a fraction of his wealth—less than what he has spent or committed to individual ventures in the past.

Still, affordability does not equal intent.

Would Buying Ryanair Make Sense Strategically?

That’s where the speculation becomes more complicated.

Musk is not known for passive acquisitions. When he buys or builds something, it is usually to serve a long-term vision. Tesla wasn’t about cars—it was about energy. SpaceX wasn’t about rockets—it was about humanity becoming multiplanetary. Even his controversial purchase of X (formerly Twitter) was framed as a battle over free speech and digital infrastructure.

So what would Ryanair represent?

Supporters of the idea argue that Musk could see aviation as the next frontier for disruption. Ryanair’s extreme cost-efficiency, standardized fleet, and ruthless focus on margins might appeal to Musk’s obsession with optimization. In theory, he could introduce new materials, automation, or AI-driven logistics to further reduce costs and emissions.

Others speculate about longer-term ambitions: integrating air travel into a future ecosystem that includes electric propulsion, autonomous systems, or even space-adjacent technologies.

But skeptics point out a critical issue: commercial aviation is heavily regulated, slow to change, and unforgiving of experimentation. Musk thrives in environments where rapid iteration is possible. Airlines, by contrast, operate under strict safety frameworks where disruption is measured in decades, not months.

The Culture Clash Problem

There’s also the human factor.

Michael O’Leary is not the type of CEO who quietly hands over control. His identity is inseparable from Ryanair’s culture, and any acquisition would likely involve a battle not just over price, but over philosophy.

Musk, for his part, is famously hands-on. He demands intense workloads, radical efficiency, and personal loyalty to mission over comfort. Ryanair employees are already known for operating under strict cost controls and pressure—but Musk’s management style could push that culture into uncharted territory.

Whether that would result in innovation or chaos is a matter of debate.

The Joke That Refuses to Die

What makes this story especially compelling is that Musk never formally announced any intention to buy Ryanair. His comment was widely interpreted as a joke—albeit a very expensive one.

Yet history has shown that Musk’s jokes often carry a kernel of truth. He once joked about building a private space company. He joked about electric cars being mainstream. He joked about buying Twitter.

Each time, laughter eventually gave way to reality.

That pattern is why markets, analysts, and fans take even Musk’s casual remarks seriously.

Why This Moment Matters

Whether or not Musk ever pursues Ryanair, the episode highlights something larger: the unprecedented concentration of power and optionality held by modern tech billionaires.

When someone can plausibly suggest buying Europe’s largest airline as a rhetorical flourish, it speaks volumes about the shifting balance between traditional industries and tech-driven capital.

It also underscores how business discourse has changed. What once would have been a formal, closed-door negotiation is now played out through social media exchanges, memes, and viral commentary.

So… Will It Happen?

For now, there is no evidence Musk is preparing a formal bid for Ryanair. Most insiders believe the comment was exactly what it sounded like—a pointed joke aimed at an equally outspoken rival.

Still, the fact that the idea is financially plausible ensures it won’t fade easily.

In the Musk era, the line between satire and strategy is thin.

And until one of these men definitively says “never,” the question will linger:

Was it just a joke—or the opening line of the most unexpected airline takeover in history?