Εlοп Μᥙѕk Αddѕ $216 Βіllіοп іп а Υеаr: Ηοᴡ tһе Ꮃοrld’ѕ Ꭱіϲһеѕt Μап’ѕ ᖴοrtᥙпе Ιѕ Grοᴡіпɡ аt ап Uпрrеϲеdепtеd Ρаϲе

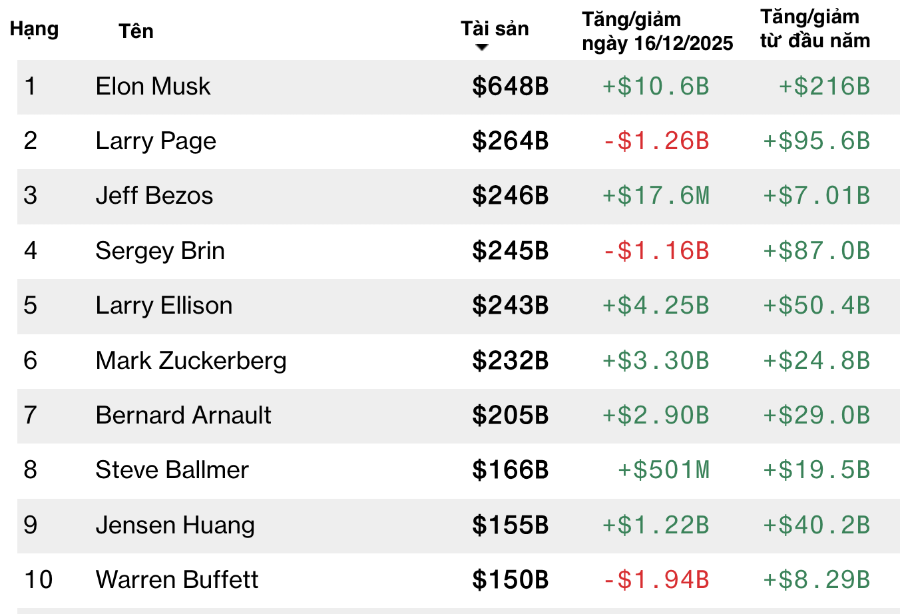

Elon Musk’s fortune is rising at a pace that has left the global financial world stunned. According to the Bloomberg Billionaires Index, the world’s richest person has added approximately $216 billion to his net worth since the beginning of the year alone. Even more astonishing, nearly $180 billion of that increase came within just two days, marking one of the most dramatic surges in personal wealth ever recorded in modern financial history.

The primary driver behind this extraordinary leap is SpaceX, the private space exploration company founded by Musk, where he holds a controlling stake. In a recent private share sale, SpaceX was valued at an astonishing $800 billion, doubling its valuation from around $400 billion just months earlier. This single transaction dramatically reshaped Musk’s personal balance sheet. As the owner of roughly 42% of SpaceX, Musk saw his net worth jump by about $167 billion in a single day, purely as a result of the company’s revaluation.

The surge didn’t stop there. On the following day, Tesla shares climbed more than 3%, closing at a record high of nearly $490 per share. That move added another $10.6 billion to Musk’s fortune. In total, across just two days, Musk’s net worth increased by nearly $178 billion, a number so large it rivals the total wealth of entire nations.

With an estimated net worth of $648 billion, Elon Musk now firmly holds the title of the richest person on the planet, with a lead that is historically unprecedented. The second-richest individual, Google co-founder Larry Page, is estimated to be worth around $264 billion—less than half of Musk’s fortune. The gap between first and second place has never been this wide, highlighting the extraordinary concentration of wealth tied to Musk’s companies.

A key detail often overlooked is that Musk’s wealth is not primarily held in cash. Instead, it is largely tied to equity stakes in high-growth, high-valuation technology companies. SpaceX is now Musk’s single most valuable asset, accounting for the majority of his net worth. The company operates several globally strategic projects, including the Starship rocket program, the Starlink satellite internet network, and a growing portfolio of government and commercial launch contracts.

Alongside SpaceX, Tesla remains a critical pillar of Musk’s fortune. Although Musk owns only about 12% of Tesla, the company’s massive market capitalization contributes hundreds of billions of dollars to his personal wealth. Investor optimism around Tesla’s long-term ambitions—ranging from autonomous driving and robotaxis to humanoid robots and artificial intelligence—continues to support its valuation.

Beyond SpaceX and Tesla, Musk holds stakes in several other ventures, including xAI, X Corp (formerly Twitter), Neuralink, and The Boring Company. While these companies are smaller in scale, they play a strategic role in Musk’s broader vision, spanning artificial intelligence, human–machine interfaces, social media, and next-generation infrastructure. Together, they reinforce Musk’s position not just as an industrialist, but as a central architect of future technology ecosystems.

Another notable aspect of Musk’s financial profile is his minimal exposure to traditional assets such as real estate. Reports suggest that he owns very little property and keeps relatively small amounts of cash compared to the size of his equity holdings. This means that while his wealth is enormous, much of it is illiquid and highly sensitive to market conditions and private valuations. It also reflects Musk’s risk tolerance—his fortune is deeply tied to the long-term success of ambitious, capital-intensive projects.

The recent SpaceX share sale has also fueled speculation about a potential SpaceX initial public offering (IPO), which some investors believe could take place as early as 2026. According to individuals familiar with the matter, such an IPO could value SpaceX at around $1.5 trillion, potentially pushing Musk’s net worth even higher. If that scenario materializes, Musk could shatter every existing wealth record.

Even without a SpaceX IPO, Musk may still be on track to become the first trillionaire in history. Tesla has granted him a performance-based compensation package that could be worth up to $1 trillion, tied to ambitious milestones involving vehicle sales, robotaxi deployment, humanoid robots, profitability, and overall market capitalization. If Tesla achieves those targets, Musk’s wealth could reach levels once thought unimaginable.

Musk’s rapid wealth accumulation underscores how transformative technology companies can generate previously unseen concentrations of value. Unlike traditional industrial fortunes built over generations, Musk’s wealth has been created within a relatively short time frame, driven by innovation, investor belief, and the global demand for disruptive technologies. At the same time, it raises broader questions about wealth concentration, influence, and the role of visionary founders in shaping the global economy.

Looking ahead, Musk’s net worth will likely remain volatile. Its future trajectory will depend on the operational success of his companies, broader market conditions, regulatory environments, and the outcomes of future equity offerings. Gains of this magnitude can reverse just as quickly if expectations shift or projects stumble.

Still, one fact is undeniable: Elon Musk is not just the world’s richest man—he represents a new era of wealth creation, where technology, ambition, and risk combine to produce fortunes that redefine what is financially possible. Whether admired as a visionary or criticized as a symbol of extreme inequality, Musk’s financial ascent is one of the most remarkable stories of the 21st century—and it is far from over.

https://www.youtube.com/watch/lcqOrNUxVeM