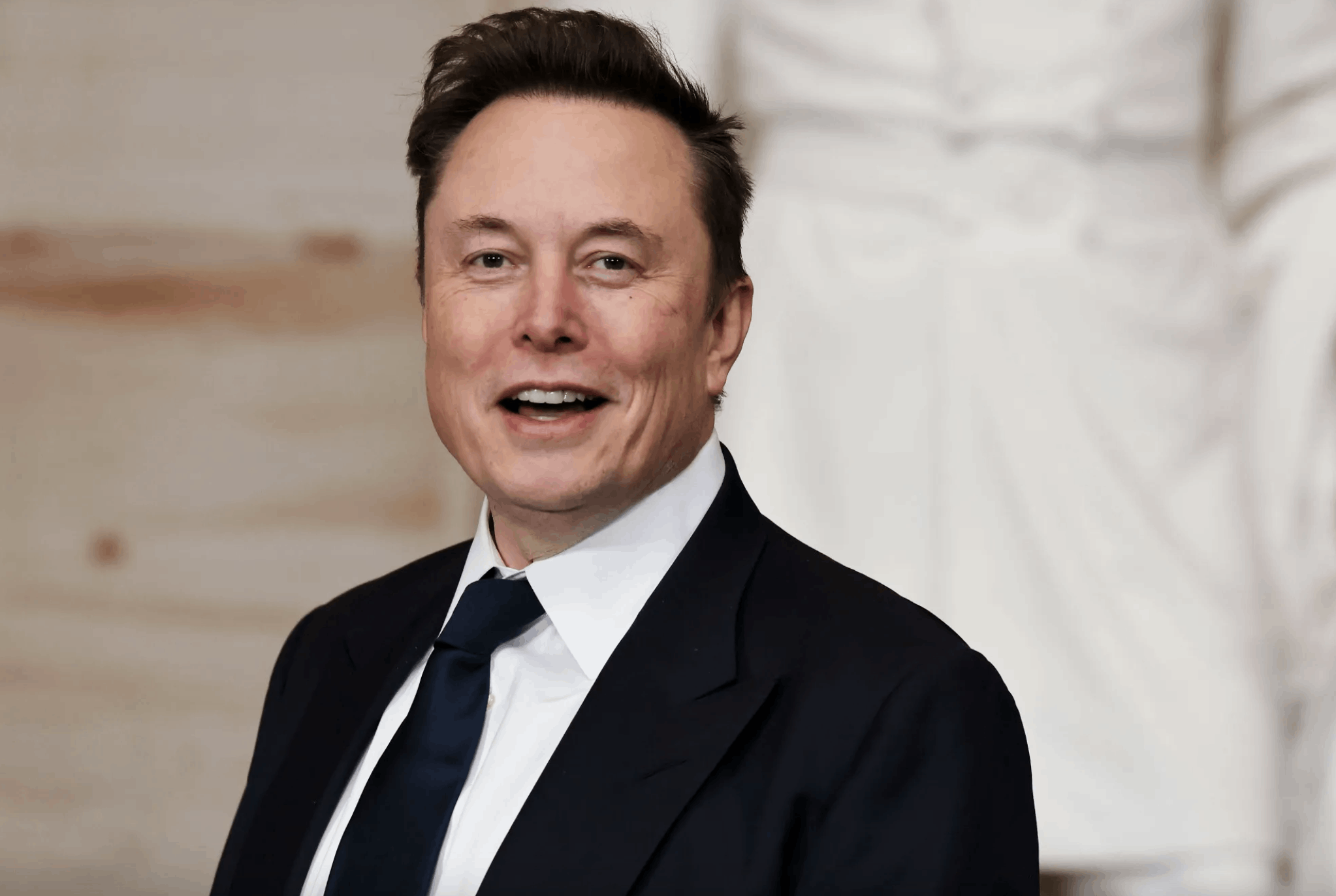

Elon Musk Announces a $5 Million “Gold Card”: Savior of the Global Economy or Just a Toy for the Ultra-Rich?

When Elon Musk speaks, markets listen. When he announces something that sounds impossible, the world pauses. And when the words “$5 million Gold Card” entered the global conversation, reactions ranged from awe to outrage, excitement to disbelief.

Is this a revolutionary financial instrument designed to stabilize a fragile global economy?

Or is it simply another exclusive gadget created for the wealthiest 0.001% of the planet?

As with most things Musk touches, the answer is far more complex—and far more controversial.

According to early discussions circulating in tech and financial circles, the so-called “Gold Card” is not a traditional credit card, nor a novelty item plated in precious metal. Instead, it is described as a high-value financial access card, potentially backed by tangible assets, advanced digital infrastructure, and cross-border financial privileges that bypass many of the inefficiencies of modern banking systems.

The price tag alone—five million dollars—instantly ignited global debate.

In a world facing inflation, debt crises, and widening inequality, the idea of an ultra-exclusive financial product feels almost provocative. Critics were quick to label it tone-deaf, calling it “a luxury lifeboat for billionaires while the ship sinks.” Social media erupted with accusations that Musk was creating yet another tool to insulate the rich from economic instability.

But supporters see something else entirely.

They argue that Musk has never built products for optics alone. From PayPal to Tesla to SpaceX, his pattern is consistent: create something that looks extreme, even absurd at first, then watch it quietly reshape entire systems. To them, the Gold Card is not about status—it’s about infrastructure.

At its core, the concept appears to challenge the traditional financial order.

The modern global economy is fragmented. Cross-border transactions are slow, expensive, and heavily regulated. Wealth mobility is restricted not just by law, but by outdated systems that struggle to keep pace with digital innovation. Musk has long criticized inefficiency in legacy institutions, particularly in finance, where middlemen often extract value without adding much utility.

The Gold Card, according to speculation, could offer its holders unprecedented financial flexibility: instant international transfers, asset-backed security, priority access to emerging technologies, and possibly integration with Musk-led ecosystems such as X, Starlink, AI platforms, and even future space-based infrastructure.

If true, this would not simply be a “card.”

It would be a private financial passport.

This is where the fear—and fascination—intensifies.

Supporters argue that innovations often begin at the top. The internet, smartphones, electric vehicles—all were once expensive tools for elites before scaling down to the masses. In this view, the Gold Card could be a testing ground for a future global financial model: faster, more transparent, and less dependent on traditional banks.

Critics, however, see a darker possibility.

What happens when financial power becomes even more concentrated? When access to stability, mobility, and opportunity is locked behind a multimillion-dollar barrier? In an already unequal world, the idea of a financial system that explicitly favors the ultra-rich raises ethical alarms.

Economists are divided.

Some suggest that such a product could actually stabilize markets by channeling large pools of capital into structured, asset-backed systems rather than speculative bubbles. Others warn it could accelerate financial segregation—creating a two-tier economy where one class operates above the rules that govern everyone else.

Musk himself has remained characteristically ambiguous.

He has neither fully confirmed nor denied the long-term vision behind the Gold Card. But ambiguity has always been part of his strategy. By refusing to explain everything upfront, he forces the world to debate the idea itself—and in doing so, reveals where systems are weakest.

There is also a psychological dimension.

Luxury products traditionally sell aspiration. Musk’s creations often sell participation in the future. Owning a Tesla was never just about transportation—it was about alignment with a vision. A $5 million Gold Card, then, may not be about wealth at all. It may be about belonging to a group that believes it is shaping what comes next.

That alone unsettles many.

Because when private individuals begin building parallel systems—financial, technological, even political—the question becomes unavoidable: who really governs the future?

Is the Gold Card a warning sign of a world where public institutions can no longer keep up? Or is it a prototype, signaling that radical innovation is the only way forward?

The global community is watching closely.

Markets reacted with volatility. Commentators filled hours of airtime. Social platforms split into camps. Yet beneath the noise lies a quieter truth: the world is hungry for new solutions, even if they arrive wrapped in controversy.

Whether the Gold Card becomes a genuine economic tool or fades as an overhyped experiment, it has already done something powerful—it exposed how fragile trust in the current system really is.

People aren’t just reacting to the card.

They’re reacting to what it represents.

A future where money moves faster than governments.

Where technology outpaces regulation.

Where visionaries, not institutions, propose the rules.

And once again, Elon Musk stands at the center of that tension—praised by some as a disruptor who sees what others don’t, criticized by others as a symbol of unchecked power.

Savior of the global economy?

Or just another privilege for the super-rich?

The truth may not be one or the other—but something far more unsettling: a glimpse of where the world is already heading, whether we’re ready or not.