Elon Musk, the CEO of Tesla and one of the most outspoken figures in technology, has once again publicly criticized Microsoft co-founder Bill Gates. This time, Musk targeted two major financial decisions made by Gates: shorting Tesla stock and reducing his stake in Microsoft. According to Musk, these choices not only caused Gates to lose out on hundreds of billions of dollars but also prevented him from potentially becoming the world’s first trillionaire.

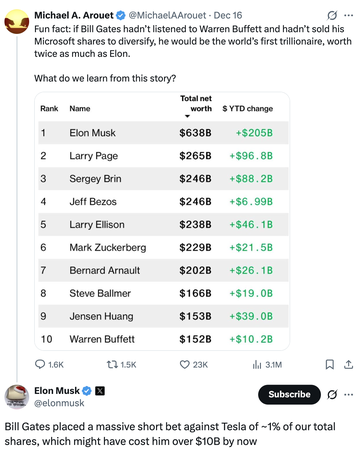

The renewed dispute emerged on X (formerly Twitter), sparked by a post from investor Michael Arouet highlighting that Bill Gates no longer ranks among the top 10 wealthiest individuals in the world. The post noted that former Microsoft CEO Steve Ballmer now holds the 8th position with an estimated net worth of around $166 billion, while Gates has fallen to 18th place with $103.8 billion. This represents a loss of nearly $24 billion in 2024 alone.

For decades, Bill Gates was nearly synonymous with extreme wealth. According to Forbes, he was the richest person globally for 18 out of 24 years between 1995 and 2017. Yet, in 2025, Gates’ net worth and ranking have noticeably declined. This sparked renewed discussion about his past financial decisions and the long-term consequences of following traditional wealth management advice versus taking high-stakes bets.

Arouet and others argue that Gates could have been the first trillionaire in history if he had retained his full Microsoft holdings and avoided certain philanthropic commitments. Gates, following advice from legendary investor Warren Buffett, diversified his assets by selling off a portion of his Microsoft shares over time. Much of this wealth was redirected into charitable foundations with his ex-wife Melinda Gates, a choice that, while generous, limited his net worth accumulation relative to the potential value of Microsoft stock.

Had Gates maintained his Microsoft stake and avoided major charitable outflows, some analysts estimate that his net worth today could have reached $1.5 trillion—roughly double the current estimated net worth of Elon Musk. Microsoft’s market capitalization has soared to around $3.6 trillion, driven largely by its leadership in cloud computing and aggressive integration of artificial intelligence. In retrospect, holding onto those shares could have dramatically altered Gates’ position among global billionaires.

Despite this, many financial observers argue that Gates’ decisions were rational at the time. After the dot-com bubble burst in the early 2000s, Microsoft’s stock experienced nearly a decade of stagnation. The company took over a decade to reach new highs, and very few investors could have predicted the explosive growth Microsoft would later achieve during the 2010s. Diversification, in that context, was a prudent move for someone whose wealth was heavily concentrated in a single company.

Nevertheless, Elon Musk seized the moment to redirect the narrative toward Tesla. Responding to Arouet’s post, Musk reminded followers that Gates had previously held a significant short position in Tesla stock—approximately 1% of the company’s outstanding shares. According to Musk, this bet against Tesla could have cost Gates more than $10 billion as the company’s share price skyrocketed in recent years.

The tension between the two tech titans isn’t new. In 2022, Bill Gates publicly confirmed his short position against Tesla, igniting further friction between him and Musk. Musk reacted sharply, accusing Gates of betting against renewable energy and opposing the global transition away from fossil fuels. Since then, Musk has repeatedly criticized Gates’ financial and strategic decisions regarding Tesla, portraying them as counterproductive not only to Gates’ wealth but also to the broader mission of clean energy adoption.

Elon Musk’s critique isn’t limited to financial moves; it also touches on contrasting worldviews. Musk has often framed Tesla as a mission-driven company focused on accelerating the transition to sustainable energy and creating a multiplanetary future through SpaceX. Gates, meanwhile, is viewed as a more conservative investor, prioritizing risk management, diversification, and philanthropy. These differing philosophies have fueled ongoing public exchanges, often sparking debates across social media platforms and the press.

This recent commentary highlights the broader narrative of wealth accumulation in the tech sector. Musk, whose net worth fluctuates dramatically based on Tesla stock price and SpaceX valuations, exemplifies the high-risk, high-reward model. Gates represents the opposite approach: cautious asset management coupled with substantial charitable giving. Musk’s criticism underscores a recurring theme in tech circles—timing, risk tolerance, and strategic bets can create vastly different outcomes for the ultra-wealthy.

The debate also reflects generational differences in tech entrepreneurship. Musk’s ventures—Tesla, SpaceX, Neuralink, and Boring Company—often operate at the cutting edge, taking bold risks that challenge conventional financial norms. Gates’ legacy, while monumental, has always emphasized stability, incremental growth, and philanthropy. By highlighting Gates’ decisions, Musk draws attention to the tension between audacious innovation and prudent asset management.

While some observers see Musk’s comments as simply personal rivalry or social media theatrics, they also serve as a broader lesson about financial strategy and opportunity costs in the age of transformative technology. Both Tesla and Microsoft are at the forefront of their respective fields—clean energy and AI—yet the paths of their founders have diverged dramatically in terms of personal wealth accumulation.

Musk’s critique, though pointed, resonates with a significant segment of the tech community that values bold risk-taking and the pursuit of large-scale impact over cautious diversification. For followers and investors, the saga is a real-time case study of how strategic decisions, market timing, and philosophical approaches to business can influence not only company outcomes but personal fortunes at the scale of hundreds of billions of dollars.

In the end, the Elon Musk-Bill Gates dispute isn’t just about money; it’s about competing visions for the future. Musk’s narrative emphasizes rapid technological advancement, aggressive financial positioning, and the societal impact of bold ventures. Gates’ path emphasizes measured growth, diversification, and philanthropy. Together, their contrasting approaches provide a fascinating lens through which to examine wealth, influence, and innovation in the modern tech era.

Regardless of who is “right” in this ongoing debate, one thing is clear: the decisions of these tech giants will continue to spark discussion and debate among investors, entrepreneurs, and the global audience for years to come. Their clash over Tesla, Microsoft, and missed opportunities is a reminder that in the world of extreme wealth and technological ambition, strategic choices can make or break fortunes on an unprecedented scale.

https://www.youtube.com/watch/93UDBcidOKU