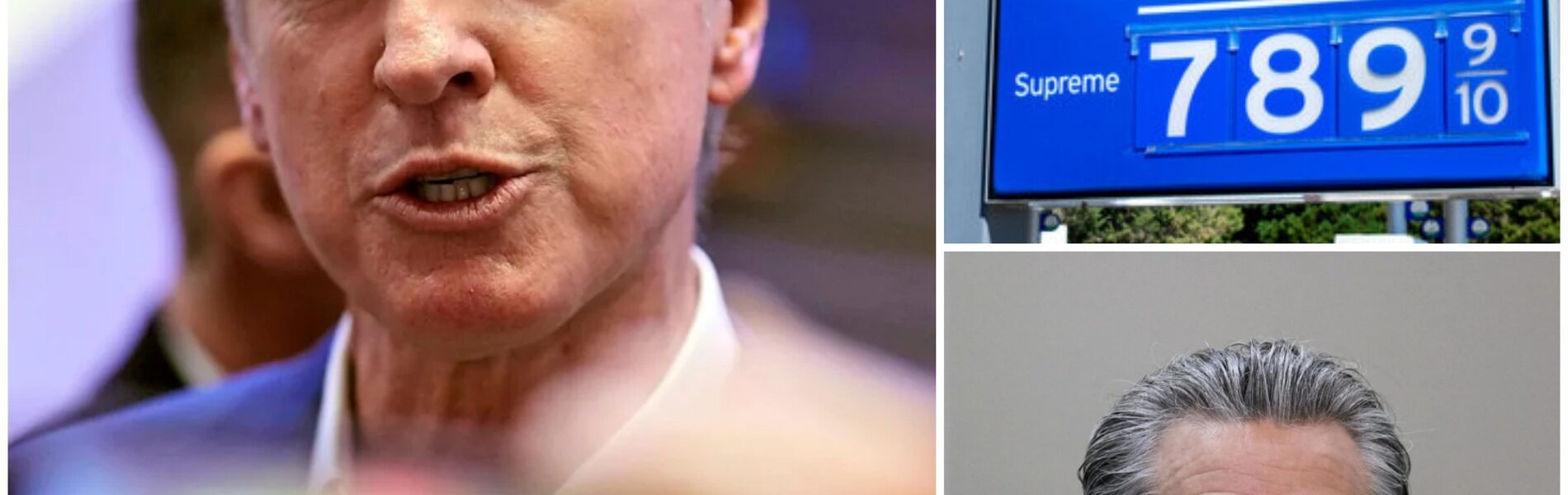

California’s Refinery Regulations Backfire Spectacularly: Phillips 66 Shuts Down Major Plant Just 48 Hours After Newsom’s “Crush Big Oil” Signing

Just 48 hours after Governor Gavin Newsom signed landmark refinery regulations on October 14, 2024 — vowing to “crush Big Oil” and protect families from price gouging — Phillips 66 delivered a devastating counterpunch: the permanent closure of its Los Angeles refinery complex, erasing 139,000 barrels per day of capacity (8% of California’s total refining output) and wiping out hundreds of union jobs overnight.The timing was impossible to ignore. Newsom had stood at the signing ceremony declaring: “Gas price spikes are profit spikes for Big Oil. Families will no longer be gouged at the pump.” Yet by October 16, Phillips 66 announced the Los Angeles facility — a sprawling dual-site operation in Carson and Wilmington, connected by a 5-mile pipeline — would shut down by the end of 2025.

The new law, Assembly Bill X2 1, handed sweeping powers to the California Energy Commission (CEC), including:

- Mandated minimum reserves of gasoline and diesel, with state-set inventory levels that ignored seasonal blends and storage limits.

- 120-day advance notice and CEC approval for any planned maintenance that would reduce output — even for safety or equipment needs.

- Daily penalties of $100,000 to $1 million if refinery margins exceeded state-determined “acceptable” thresholds, with only a 3-day window to correct violations.

Industry analysts warned the rules would make compliance nearly impossible. The combination of rigid reserves, pre-approval for routine work, and government intervention in profit margins created a regulatory maze that dramatically increased operating costs and uncertainty.Phillips 66 CEO Mark Lashier did not mince words in the company’s statement:

“The long-term sustainability of the refinery is uncertain due to market dynamics and the growing burden of operating in California. We will shift to importing gasoline and diesel using existing infrastructure.”

The closure eliminated 85,000 barrels per day of gasoline and 65,000 barrels per day of diesel and jet fuel — a massive hit to supply in a state that already imports a significant portion of its fuel. For the 600 permanent employees and 300 contractors at the plant, many earning $80,000–$120,000 annually after decades of service, the news was catastrophic. Severance was capped at 16 weeks — barely enough to bridge the gap to an uncertain future.The United Steelworkers Union called it “a disaster for workers and surrounding communities,” warning of ripple effects through local businesses, schools, and city budgets. The 650-acre site is now being eyed for redevelopment, signaling the end of a century-old refining presence in the region.Warnings had been loud and clear long before the signing. Industry groups, economists, and even some Democratic lawmakers urged caution. State Senator Brian Jones sent an unanswered letter to Newsom in May 2025 projecting gasoline prices could reach $8.43 per gallon by the end of 2026 if closures continued. USC Marshall School economists independently forecasted a 75% price spike if both Phillips 66 and Valero exited.

The crisis only deepened. In April 2025, Valero announced it would cease petroleum refining at its Benicia facility by April 2026, removing another 145,000 barrels per day — nearly 20% of California’s gasoline production erased in less than 18 months.By June 2025, the California Energy Commission itself sent a 24-page letter to Newsom warning that refining capacity was already too low to meet demand. With Phillips 66 and Valero exiting, the state would soon rely on imports for up to 30% of its gasoline — more than double pre-closure levels. The CEC urged a pause on profit penalties and cooperation with refiners — recommendations the governor initially ignored.Gasoline prices in California soared to an average of $4.61 per gallon by June 2025, with Los Angeles stations topping $6 and San Francisco approaching $7. Arizona and Nevada saw 50% jumps as their fuel flows through California pipelines.In September 2025, Newsom signed Senate Bill 237, fast-tracking new drilling permits in Kern County — a stunning reversal from his pledge to end oil drilling by 2045. The same administration that once vowed to punish Big Oil was now scrambling to keep it afloat.Critics say the governor’s aggressive regulations — sold as consumer protection — have instead accelerated refinery exits, reduced in-state supply, and driven prices higher.

Supporters argue the closures were inevitable due to global market shifts and that Newsom’s policies are necessary for climate goals.For California families already stretched thin, the math is unforgiving. At $4.61 per gallon (and rising), a typical driver consuming 480 gallons per year is spending $2,213 annually — hundreds more than the national average. If imports dominate and prices hit $8+, that bill could double.The warnings were ignored.

The closures came anyway.

And now, the market is delivering its verdict.